“This actually works.”

“My best investment decision.”

“Finally, something legit.”

Discover market beating stocks. Powered by data science.

Discover market beating stocks. Powered by data science.

✓ Rated 4.9/5

MonkStreet's systematic approach to stock selection , grounded in decades of research, consistently outperforms the market.

Maximize your returns. Minimize your risks. Save time and effort.

This is how it works

As simple as 1, 2, 3...

(but with more than 300 research papers backing it up).

- 1

Fundamental Analysis

We monitor more than 40,000 companies worldwide and analyze the fundamental factors that have the strongest predictive power for their future performance.

- 2

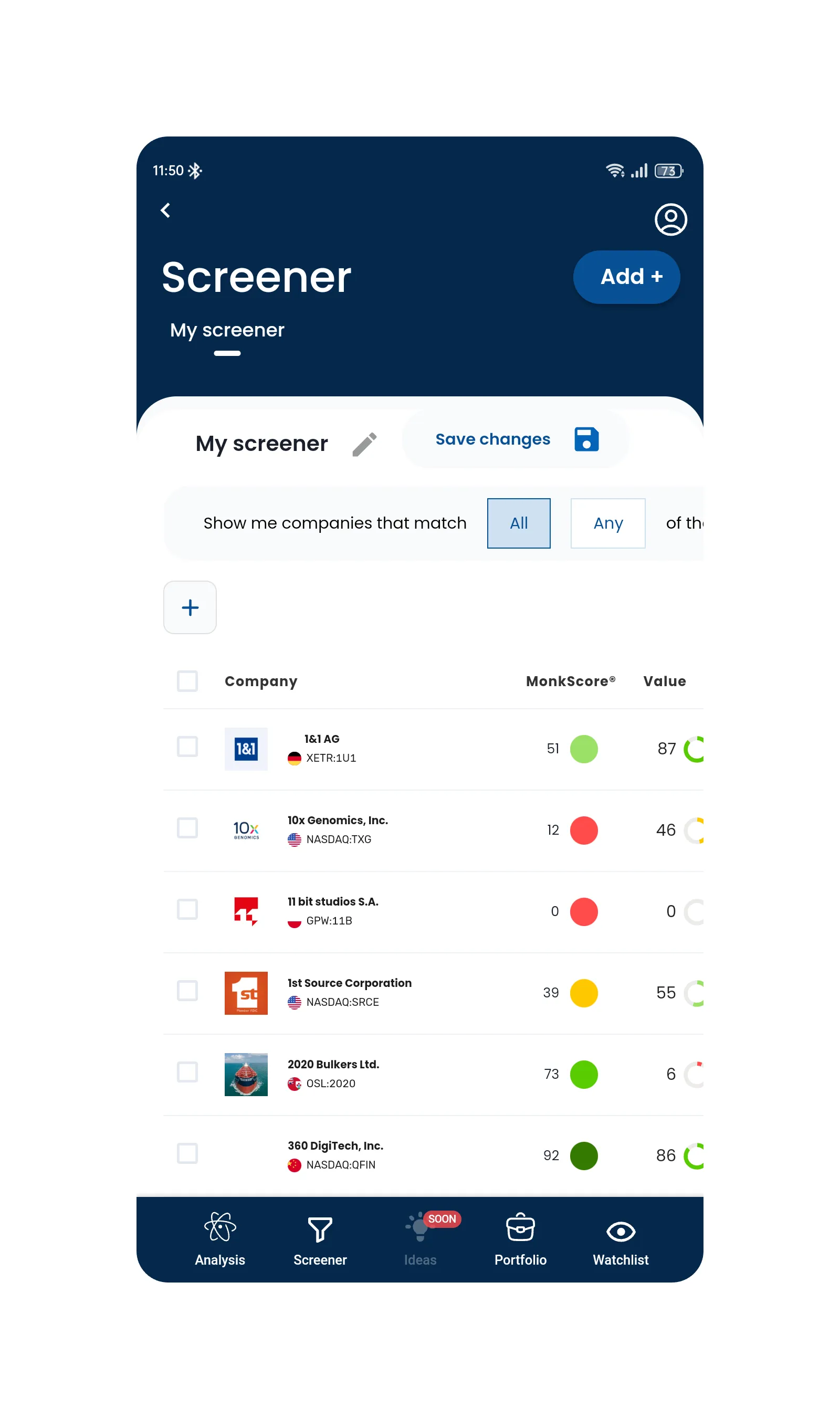

Company Ranking

We rank every company from best to worst for each of these factors, and use big data and AI to combine the rankings into a straightforward and effective metric called the MonkScore.

- 3

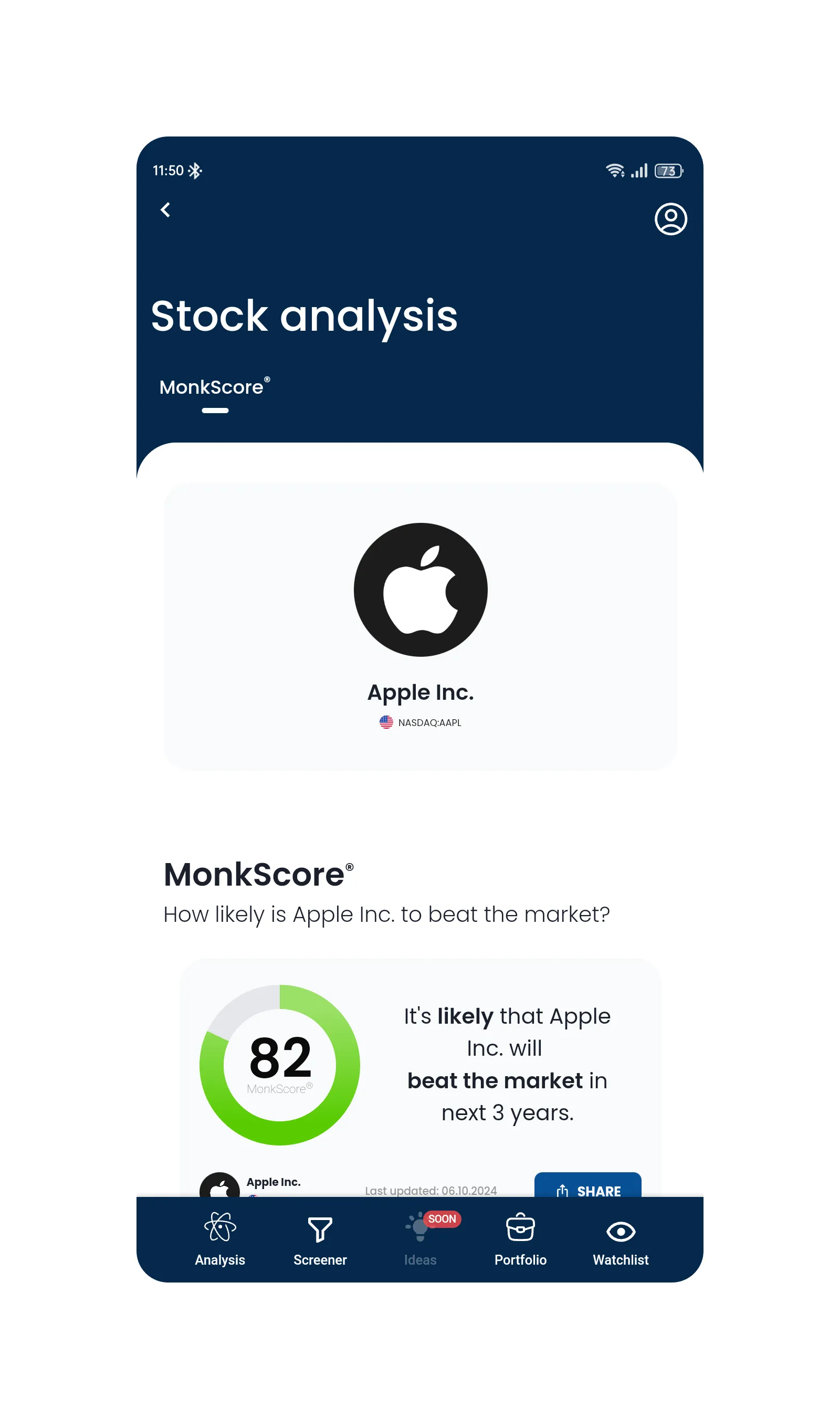

MonkScore®

Stocks with the highest MonkScore® are more likely to beat the market in the long-term according to science.

Features

These are just some of the superpowers you get when you use MonkStreet.

Valuation

Excellent price

90Growth

Very good growth 🤞

99Profitability

Good profitability

60Health

Strong financial strength

94Payout

Consistency in distribution

87Earnings Quality

Lowering the risks

77Momentum

Strong monitoring

92

Science-Backed Fundamental Analysis

No need to spend hours crunching numbers. Just enter a name and get accurate quantitative insights for any company.

Alerts coming soon!

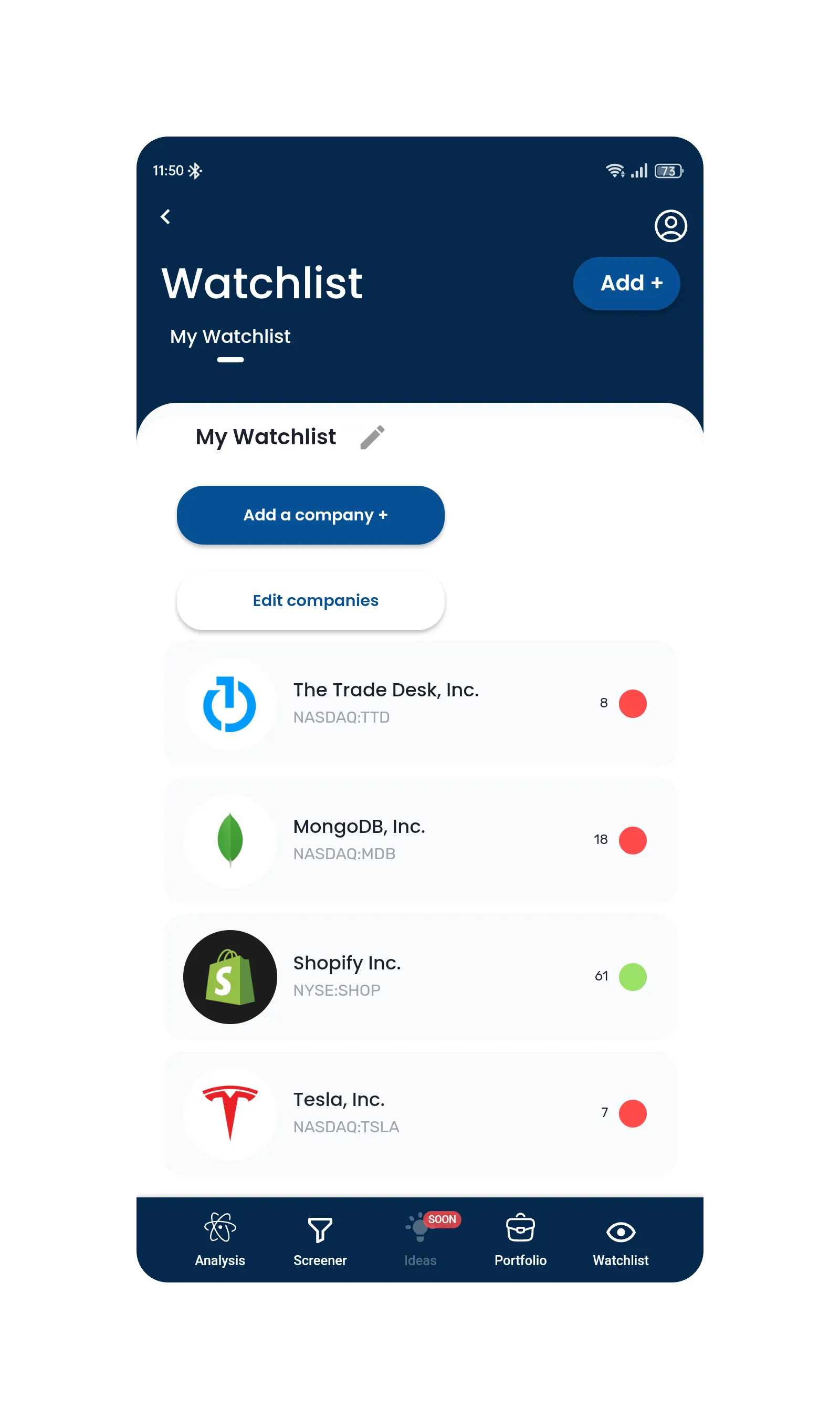

Alerts coming soon!Personalized Watchlist

Keep track of your favorite stocks without any effort and receive timely alerts on significant changes.

Powerful Screener

Find the best stocks based on your own investing style. Scan the market for value, growth or dividend opportunities among others. Sort and rank stocks by any factor.

Fundamental factors

To calculate the MonkScore®, we analyze hundreds of ratios and combine them in 5 key factors.

Value

Identify companies that are trading at a discount to their assets, current financials, and growth potential.

Growth

Discover companies with bright growth potential based on their performance and industry conditions.

Profitability

Spot companies with superior profitability, as this is a precursor for high potential for shareholder returns.

Health

Detect companies with strong financial health, as they are more resilient to market turbulence.

Payout

Pinpoint companies that consistently distribute dividends or execute timely buybacks, demonstrating their commitment to their investors.

«If a business does well, the stock eventually follows.»

See it for yourself!

Start finding market beating stocks right now!

BENEFITS

Using MonkStreet, you can make informed decisions based on data-driven analysis.

Maximize your returns

Avoid companies unlikely to yield favorable returns, safeguarding your investment and minimizing risk.

Minimize the risks

Avoid companies unlikely to yield favorable returns, safeguarding your investment and minimizing risk.

Save time and effort

Spend your valuable time investigating only those stocks with the highest probability of beating the market.

WALL OF LOVE

Don’t take our word for it. See what our clients say.

Is MonkStreet right for you?

Fit or fail? MonkStreet is NOT the right tool for everyone.

MonkStreet is great for...

- Long term investors who plan to buy and hold.

- Beginner investors who want to build a solid portfolio.

- Value investors, looking for high-quality, low-price companies.

- Growth investors, focused on finding the winners of tomorrow.

- Income investors prioritizing dividends.

MonkStreet won’t help if...

- You plan to hold your stocks for less than 1 year.

- You are looking for a get-rich-quick scheme.

- You are not willing to accept volatility.

- You are looking for speculative investments.

See it for yourself!

Start finding market beating stocks right now!

Frequently Asked Questions

Still have doubts? We are happy to help!

MonkStreet is an investment analysis platform that helps you find, buy, and hold exceptional businesses over time. Using our proprietary MonkScore® system, we analyze companies on a 0-100 scale to identify truly outstanding businesses from a fundamental point of view. Our systematic approach not only helps you spot excellence but also gives you the confidence to hold these gems when Mr. Market goes bananas.

Our methodology is built on over 300 peer-reviewed academic papers and extensive backtesting. Companies with top MonkScores® have achieved 85.3% returns over three years with a 51.4% probability of beating the market. In comparison, the average stock has only a 30.5% chance of outperforming. We believe in transparency, and our research is built on decades of quantitative investing principles.

MonkStreet is for long-term investors who seek to build wealth by owning great businesses over time. If you are looking for day trading signals, technical analysis, or short-term market timing, MonkStreet is not the right tool for you.

Monk Street in 2 minutes

An image is worth a thousand words